Sunny in northeast Florida: More signs of a housing rebound

Residential real estate markets continued

to recover in northeast Florida, according to a recent poll conducted by the

Atlanta Fed. In late June, staff from our Jacksonville Branch along with the

Bank's Center for Real Estate Analytics met with nearly 250 real estate

professionals at the Florida Realtors conference in St. Augustine, Florida.

Conference participants hailed from the Jacksonville, St. Augustine, Flagler,

Gainesville, Lake City, and Amelia Island areas, and most were residential real

estate professionals. We asked a series of questions to ascertain the state of

the residential real estate markets in northeast Florida. Their responses

showed that conditions continued to improve.

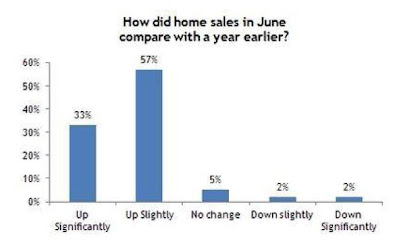

For

example, a significant majority reported that June home sales exceeded the

year-earlier level.

In addition, the

sales outlook for the remainder of the year was positive as most expected

modest gains on a year-over-year basis.

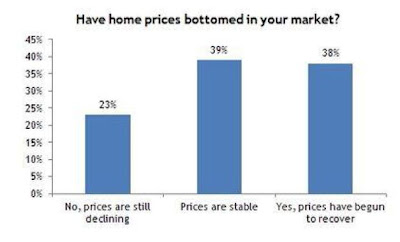

Importantly,

most participants agreed that home prices have bottomed or begun to recover.

And the majority

of respondents anticipate modest home price growth during the second half of

2012 compared with a year earlier.

While these responses represent only a

segment of the regional housing market, we read the results as further

indication that the hard-hit residential real estate markets are making

progress toward recovery.

By Jessica Dill & Whitney Mancuso, senior economic analysts

in the Atlanta Fed's research department