Chad Stewart's Lake City Florida Real Estate Blog.

Chad Stewart is a Real Estate Pro with Rockford Realty Group. I personally update andmaintain my website and this blog. North Florida is a great place to live and work. I work with buyers and sellers for real estate in Lake City, FL, Columbia County, Florida & the surrounding areas. Check back frequently to this blog for Florida real estate news, Market info, technology updates more Lake City FL Real Estate info. Rockford Realty Group

Monday, August 12, 2013

Friday, July 06, 2012

Sunny in northeast Florida: More signs of a housing rebound

Sunny in northeast Florida: More signs of a housing rebound

Residential real estate markets continued

to recover in northeast Florida, according to a recent poll conducted by the

Atlanta Fed. In late June, staff from our Jacksonville Branch along with the

Bank's Center for Real Estate Analytics met with nearly 250 real estate

professionals at the Florida Realtors conference in St. Augustine, Florida.

Conference participants hailed from the Jacksonville, St. Augustine, Flagler,

Gainesville, Lake City, and Amelia Island areas, and most were residential real

estate professionals. We asked a series of questions to ascertain the state of

the residential real estate markets in northeast Florida. Their responses

showed that conditions continued to improve.

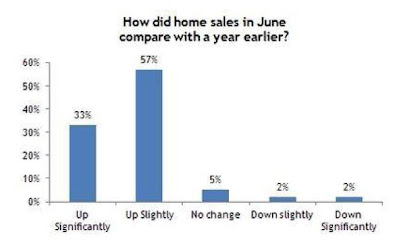

For

example, a significant majority reported that June home sales exceeded the

year-earlier level.

In addition, the

sales outlook for the remainder of the year was positive as most expected

modest gains on a year-over-year basis.

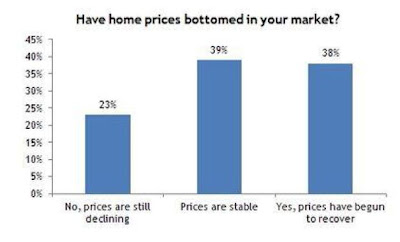

Importantly,

most participants agreed that home prices have bottomed or begun to recover.

And the majority

of respondents anticipate modest home price growth during the second half of

2012 compared with a year earlier.

While these responses represent only a

segment of the regional housing market, we read the results as further

indication that the hard-hit residential real estate markets are making

progress toward recovery.

By Jessica Dill & Whitney Mancuso, senior economic analysts

in the Atlanta Fed's research department

Thursday, July 05, 2012

‘Dead’ listings get new life The big drop in inventories of homes for-sale helps once-expired listings finally get sold. Many sellers find that relisting their properties now affords more luck now than a few months ago, real estate professionals report. Now may be the right time to sell... http://www.chadstewart.com

Saturday, June 09, 2012

Monday, May 21, 2012

Economists more upbeat about job growth, housing

Economists more upbeat about job growth, housing. News Link Here.

Economists more upbeat about job growth, housing. News Link Here.Florida Economic Outlook: May 2012. Economics Group - Wells Fargo.

Full Report Here:

Local Housing Market Update for Columbia County - April 2012

Download PDF info here

Wednesday, April 11, 2012

Time Management in a Nutshell - Being more

My Brother who is a successful Short Sale Negotiator and Realtor ran across these, and we both think they are really good tips. By the way, we both work together on real estate & short sales.

Time Management in a Nutshell

Be prepared to make drastic changes. Be creative to find and introduce

different ways of doing things. Assess what efforts and activities are most

productive, and which are not.

Manage your emails and phone calls - don't let them manage you. Ideally

check at planned times, and avoid continuous notification of incoming emails.

Really think about how you currently spend your time. If you don't know,

keep a time log for a few days to find out. Knowing exactly what's wrong is

the first step to improving it.

Challenge anything that could be wasting time and effort, particularly habitual

tasks, meetings and reports where responsibility is inherited or handed down

from above. Don't be a slave to a daft process or system.

Plan preparation and creative thinking time in your diary for the long-term

jobs, because they need it. The short-term urgent tasks will always use up all

your time unless you plan to spend it otherwise.

You must plan time slots for unplanned activities - you may not know exactly

what you'll need to do, but if you plan the time to do it, then other important

things will not get pushed out of the way when the demand arises.

Use the 'urgent-important' system of assessing activities and deciding

priorities. Important is more important than Urgent.

When you're faced with a pile of things to do, go through them quickly and

make a list of what needs doing and when. After this handle each piece of

paper only once. Do not under any circumstances pick up a job, do a bit of it,

then put it back on the pile.

Do not start lots of jobs at the same time - even if you can handle different

tasks at the same time it's not the most efficient way of dealing with them, so

don't kid yourself that this sort of multi-tasking is good - it's not.

For all your real estate sales, home short sale selling needs contact Chad Stewart - Rockford Realty Group. Realtor & licensed mortgage broker - short sale consultant.

Time Management in a Nutshell

Be prepared to make drastic changes. Be creative to find and introduce

different ways of doing things. Assess what efforts and activities are most

productive, and which are not.

Manage your emails and phone calls - don't let them manage you. Ideally

check at planned times, and avoid continuous notification of incoming emails.

Really think about how you currently spend your time. If you don't know,

keep a time log for a few days to find out. Knowing exactly what's wrong is

the first step to improving it.

Challenge anything that could be wasting time and effort, particularly habitual

tasks, meetings and reports where responsibility is inherited or handed down

from above. Don't be a slave to a daft process or system.

Plan preparation and creative thinking time in your diary for the long-term

jobs, because they need it. The short-term urgent tasks will always use up all

your time unless you plan to spend it otherwise.

You must plan time slots for unplanned activities - you may not know exactly

what you'll need to do, but if you plan the time to do it, then other important

things will not get pushed out of the way when the demand arises.

Use the 'urgent-important' system of assessing activities and deciding

priorities. Important is more important than Urgent.

When you're faced with a pile of things to do, go through them quickly and

make a list of what needs doing and when. After this handle each piece of

paper only once. Do not under any circumstances pick up a job, do a bit of it,

then put it back on the pile.

Do not start lots of jobs at the same time - even if you can handle different

tasks at the same time it's not the most efficient way of dealing with them, so

don't kid yourself that this sort of multi-tasking is good - it's not.

For all your real estate sales, home short sale selling needs contact Chad Stewart - Rockford Realty Group. Realtor & licensed mortgage broker - short sale consultant.

Wednesday, April 04, 2012

Foreclosure VS Short Sale

This is general information & concepts. I suggest talking with an attorney or tax professional....

Short sales can be very complex... Often borrowers tell the Bank to “just foreclose” either as an act of desparation or as a negotiation tactic, but in reality, Short sale agreement is a much better way to go, and come careful planning & consulting by Realtors, Attorneys, and Tax professionals can get you into a much better position in the long run.

There will come a point where it will be well worth accepting a Short Sale on the 1st mortgage and a settlement or small payoff plan on the 2nd mortgage…. Here is why…

Short Sale

First Mortgage often forgives substantial amount in writing , IRS tax free per current short sale laws.

Offers from 2nd mortgage are often in the form of cash settlement or as a payment plan option in writing, and IRS tax free as well.

Foreclosure

2nd mortgage rights to the property are “wiped away”, but they usually retain rights to a deficiency judgment.

1st mortgage, especially in down markets have filing for a motion for deficiency after the foreclosure sale, this often results in a certified court judgment for the deficiency, in many cases this can be hundreds of thousands of dollars (not cool)

In reality, Short sale agreement is a much better way to go. Massive settlement on the first mortgage gets done, and you can continue to work in the 2nd mortgage, or often even the 2nd mortgage is settled at closing.

Again, these are general concepts & information. Every lender can be different, Every investor can be different, and I reccommend contacting qualified professionals to assist you with your real estate Short Sale.

Tuesday, April 03, 2012

The Mortgage Forgiveness Debt Relief Act and Debt Cancellation - Short Sales

There are alot of Questions regarding Short Sales & the IRS taxes afterwards...

Regarding the IRS taxes, right now there is an Act called Mortgage forgiveness and debt relief act..

The Mortgage Debt Relief Act of 2007 generally allows taxpayers to exclude income from the discharge of debt on their principal residence. Debt reduced through mortgage restructuring, as well as mortgage debt forgiven in connection with a foreclosure, qualifies for the relief.

From this link…

· HomeOwners:

Qualified principal residence indebtedness: This is the exception created by the Mortgage Debt Relief Act of 2007 and applies to most homeowners.

Investors:

· Insolvency: If you are insolvent when the debt is cancelled, some or all of the cancelled debt may not be taxable to you. You are insolvent when your total debts are more than the fair market value of your total assets.

I would recommend checking with your accountant on this regarding the Insolvency category, and if it would apply. .

If not, you also may be able to take a Capital Loss that would usually cover the short sale “Income”.. See info here

Thursday, March 29, 2012

Westfield Realty and Burbach Realty Have Merged!

FOR IMMEDIATE RELEASE:

Westfield Realty and Burbach Realty Have Merged!

Now called ROCKFORD REALTY GROUP.

Familiar Faces, New Name.

Lake City, FL – February 10, 2012 - Westfield Realty Group and Burbach Realty Services have officially joined forces to form Rockford Realty Group. This merger brings together two successful companies that have continuously ranked well in their regional market, allowing them to compete more effectively in today’s challenging Real Estate market.

The merger was officially announced by Broker, Charlie Sparks, on December 1, 2011. On the company merger, Charlie says, “We will continue to work hard to earn your business, and we would like to personally thank you for your continued support.”

With 125 years of combined Real Estate experience, Rockford Realty Group is confident that they will live up to their slogan “Exceeding Expectations”. With both companies working together, it is sure to bring a fresh perspective on training, technology and marketing.

Although Westfield Realty and Burbach Realty have had separate histories, they both have always shared the same objective: to ensure absolute customer satisfaction. As Rockford Realty Group, the agents remain dedicated to that objective.

Existing sales, service, and support contacts remain unchanged so that the public may continue to use the same communication channels as before. The company merger will be a smooth process with no disruption to customer service.

--

Chad Stewart has been a Broker or Associate with both companies and is excited to continue working for his customers at Rockford Realty Group

Chad Stewart can be contacted at 386-487-1463 or http://www.chadstewart.com

Westfield Realty and Burbach Realty Have Merged!

Now called ROCKFORD REALTY GROUP.

Familiar Faces, New Name.

Lake City, FL – February 10, 2012 - Westfield Realty Group and Burbach Realty Services have officially joined forces to form Rockford Realty Group. This merger brings together two successful companies that have continuously ranked well in their regional market, allowing them to compete more effectively in today’s challenging Real Estate market.

The merger was officially announced by Broker, Charlie Sparks, on December 1, 2011. On the company merger, Charlie says, “We will continue to work hard to earn your business, and we would like to personally thank you for your continued support.”

With 125 years of combined Real Estate experience, Rockford Realty Group is confident that they will live up to their slogan “Exceeding Expectations”. With both companies working together, it is sure to bring a fresh perspective on training, technology and marketing.

Although Westfield Realty and Burbach Realty have had separate histories, they both have always shared the same objective: to ensure absolute customer satisfaction. As Rockford Realty Group, the agents remain dedicated to that objective.

Existing sales, service, and support contacts remain unchanged so that the public may continue to use the same communication channels as before. The company merger will be a smooth process with no disruption to customer service.

--

Chad Stewart has been a Broker or Associate with both companies and is excited to continue working for his customers at Rockford Realty Group

Chad Stewart can be contacted at 386-487-1463 or http://www.chadstewart.com

Neighborhood Stabilization Program - Columbia County FL

Lake City Board of Realtors:

Columbia County has been awarded Round 3 of the Neighborhood Stabilization Program Grant.

The Neighborhood Stabilization Program 3 (NSP3) was established for the purpose of stabilizing communities that have suffered from foreclosures, short sales, and abandonment. Through the purchase and redevelopment of these properties, the goal of the program is being realized. Columbia County is preparing to begin the NSP3 program. Legislation was passed which provides grants to all states and selected local governments on a formula basis. Columbia County received $1,029,844.00 and is implementing two strategies for the use of NSP3 funds, these include property acquisition and rehabilitation for resale to income eligible home buyers and for acquisition and rehabilitation to provide and support the need for affordable rental housing stock and special needs housing supported by non-profit organizations

Please see the Columbia County Website for details.

Tommy Matthews, Projects Superintendent

Columbia County Board of Commissioners

Friday, February 03, 2012

What happens when you have to walk away from your home?

If you are living in a underwater mortgaged home, it can be a huge and very tough decision to walk away form your home. Each person must make a decision that works for them morally and financially, but also each person must face reality with a bold & realistic attitude as well. Alternatives to a short sale is a home loan modification as well, but those are many times unsuccessful. Weigh your options carefully & don't make the decision too hastily either. Keep in mind that sometimes the best decisions are not the easiest decisions.

Check out this article from Reuters - Yahoo Finance.

http://finance.yahoo.com/news/what-happens-when-you-walk-away-from-your-home-.html

Check out this article from Reuters - Yahoo Finance.

http://finance.yahoo.com/news/what-happens-when-you-walk-away-from-your-home-.html

- Pros: Settle Debt, Move on with your life, Tax Free on the "income" you received thru the debt settlement at the moment,

- Cons: 85-160 hit on your credit rating, Embarrassing, Higher interest rates when you borrow again.

Monday, January 30, 2012

To Buy or to Sell a House in the Lake City, FL Real Estate Market

If you are interesting in selling your property, now would be a good time to put it on the market. We have noticed a measurable increase in the number of buyers, prospects, and overall market activity right now in the Lake City, FL area.

With approximately a 12 month supply of residential homes for sale in the Lake City, FL area, prices are still low & will most likely remain stable for this year. However, because of the drastic drop in home values over the past few years, if you are waiting to see the market come back before you sell, it could be a very very long time.

Perhaps a better plan to consider would be to sell your home now, and buy your next home while price are low. You will loose some, but you will more than gain in the buying power of your money right now on the purchase whether upgrading or downsizing.

Also a option is to sell it as a short sale if you are underwater regarding the equity in your home. This will get you out of a high monthly obligation, most likely settle your debt, and free up your monthly resources. Even though your credit will be hit, if you rent for a year or two, and get back into something at today's prices, you would mostly likely be in a much better financial situation in a few years.

With approximately a 12 month supply of residential homes for sale in the Lake City, FL area, prices are still low & will most likely remain stable for this year. However, because of the drastic drop in home values over the past few years, if you are waiting to see the market come back before you sell, it could be a very very long time.

Perhaps a better plan to consider would be to sell your home now, and buy your next home while price are low. You will loose some, but you will more than gain in the buying power of your money right now on the purchase whether upgrading or downsizing.

Also a option is to sell it as a short sale if you are underwater regarding the equity in your home. This will get you out of a high monthly obligation, most likely settle your debt, and free up your monthly resources. Even though your credit will be hit, if you rent for a year or two, and get back into something at today's prices, you would mostly likely be in a much better financial situation in a few years.

Thursday, January 26, 2012

Florida is ranked #5 out of 50! Great for Business

Fla. No. 5 nationally as ‘best for business’

WASHINGTON – Jan. 26, 2012 – Wyoming, Florida and Texas rank among the 10 best states for taxes on business, while companies in states like New York, New Jersey and California have a far less pleasant tax climate, according to the Tax Foundation’s State Business Tax Climate Index, now in its 8th edition.

The Tax Foundation says it looks at dozens of state tax provisions to create the ranking –a single easy-to-use score that measures each state’s tax climate against every other state. While some similar studies focus on residents’ tax burden they pay each year, the Index focuses on how a tax system enhances or harms a state’s businesses.

The Tax Foundation says it looks at dozens of state tax provisions to create the ranking –a single easy-to-use score that measures each state’s tax climate against every other state. While some similar studies focus on residents’ tax burden they pay each year, the Index focuses on how a tax system enhances or harms a state’s businesses.

Tuesday, January 17, 2012

NAR affordability index in the south is now over 200.

In other words the median income is double what it needs to be to buy the median price home

In the early 80’ the index was about 68 which meant the median I income was a little more than half of what was needed to buy the median price house.

Monday, January 09, 2012

Short Sale Market Update in Lake City, FL

"Seems to be right on with my expectation for the market. Lots of sales, but more soft prices and shorts until we clear up the current economic situation that many home sellers got themselves into. Massive over-leveraged debt is no longer in fashion, and that sentiment extends even to the big banks. The federal government doesn’t seem to interested in austerity, but capitalistic corporations see the need to right-size before they capsize.

Some short sale trends I expect to see:

-We will start to see the major lenders and even some of the smaller lenders start to waive or reduce deficiencies, even on secondary homes and investment properties.

-For properties in markets that are still predicted to drop, we will see more lender incentives (cash to seller, simpler review processes, etc) to get shorts done.

-Modifications will really take a back seat lenders rush to de-leverage.

-The people that have gotten used to not making a payment for 2 years will suddenly find time has run out, and in these cases of severe delinquency, it will be almost impossible to modify, and may be almost as hard to short sale, as the banks will mandate their foreclosure attorneys to clear out bad assets as quickly as possible.

-2012 may be a bloodbath for the lenders, but it will bring much needed liquidity to the market, and will be a haven for Buyers, and hard working Realtors."

Rob Stewart,

Short Sale Specialist,

Rockford Realty Group

Now is the time to Short Sale. Tax Advantages Could End Soon.

You may owe federal income taxes in 2013 if you have a short sale, foreclosure

WASHINGTON – Jan. 9, 2012 – You may owe federal income taxes in 2013 if you have a short sale, foreclosure after this year. Now is the time to make the hard decision: Are you going to walk away from your underwater home?

Uncle Sam is still giving homeowners until Dec. 31, 2012, to go through a short sale or foreclosure without tax consequences – as long as the lender officially releases the debt.

But on Jan. 1, 2013, the rules change: The amount a lender forgives, ether in a short sale or foreclosure, on a primary residence will be taxable on federal income taxes.

Uncle Sam is still giving homeowners until Dec. 31, 2012, to go through a short sale or foreclosure without tax consequences – as long as the lender officially releases the debt.

But on Jan. 1, 2013, the rules change: The amount a lender forgives, ether in a short sale or foreclosure, on a primary residence will be taxable on federal income taxes.

Tuesday, October 04, 2011

Lake City Florida - Real Estate Market Update

Quick Market Update:

Right now there are over 380 homes in Columbia County - Lake City area for sale.

Of those total 380 homes listed for sale.

72 are short sales

19 are bank owned or foreclosures.

That leaves alot of other sellers that have their homes on the market.

There are 40 homes currently under contract (Pending) in this area.

There have been 212 homes that have sold this year in the Columbia County, Fort White, Lake City, FL areas. Out of those, 30 have been short sales, 59 banked owned for foreclosures, making the total sales over 40% of our market is distressed properties.

Chad Stewart

Real Estate Pro

Burbach Realty Services.

Right now there are over 380 homes in Columbia County - Lake City area for sale.

Of those total 380 homes listed for sale.

72 are short sales

19 are bank owned or foreclosures.

That leaves alot of other sellers that have their homes on the market.

There are 40 homes currently under contract (Pending) in this area.

There have been 212 homes that have sold this year in the Columbia County, Fort White, Lake City, FL areas. Out of those, 30 have been short sales, 59 banked owned for foreclosures, making the total sales over 40% of our market is distressed properties.

Chad Stewart

Real Estate Pro

Burbach Realty Services.

Monday, September 26, 2011

What does Short Sale do to Credit & Credit FICO score vs Foreclosure

Audio Podcast that I liked.

How does a Short Sale affect Credit? << Click for Podcast Audio

from: Rob Stewart, Short Sale Realtor with Burbach Realty, Hope Consulting.

Q&A on Short Sales.

How does a short sale affect your credit & credit score?

Answer varies with one biggest question. What is your credit to start with? People that went into short sale being late on credit cards, late on car payments, 12 months late on mortgage, this was the first positive thing they did for their credit & their score actually went up. Credit bureau sees it is they are doing something actually positive to fix their financial situation, vs going into foreclosure & default. People that have never missed a payment, but did short sale got hit pretty bad.

Average hit to FICO score is 75 points, but what you got to know what is far more important that hit on score is the affect that a foreclosure will do. Knock you 200-300 points, stay on records for 7 years, hard to rent, credit card may decline you. With a short sale will be on your record with FHA for about 2 years, and as long as you get your score back up and could potentially buy another home quickly, especially if everything else on credit is clean. Credit impact varies on a whole bunch of factors.

http://blog.chadstewart.com/feeds/posts/default?alt=rss

How does a Short Sale affect Credit? << Click for Podcast Audio

from: Rob Stewart, Short Sale Realtor with Burbach Realty, Hope Consulting.

Q&A on Short Sales.

How does a short sale affect your credit & credit score?

Answer varies with one biggest question. What is your credit to start with? People that went into short sale being late on credit cards, late on car payments, 12 months late on mortgage, this was the first positive thing they did for their credit & their score actually went up. Credit bureau sees it is they are doing something actually positive to fix their financial situation, vs going into foreclosure & default. People that have never missed a payment, but did short sale got hit pretty bad.

Average hit to FICO score is 75 points, but what you got to know what is far more important that hit on score is the affect that a foreclosure will do. Knock you 200-300 points, stay on records for 7 years, hard to rent, credit card may decline you. With a short sale will be on your record with FHA for about 2 years, and as long as you get your score back up and could potentially buy another home quickly, especially if everything else on credit is clean. Credit impact varies on a whole bunch of factors.

http://blog.chadstewart.com/feeds/posts/default?alt=rss

SHIP has Money to Lend

SHIP has money to lend

SHIP applicants in Columbia, Lafayette, Madison,

Suwannee, and Union County can qualify for down

SHIP payment assistance for amounts between

$12,000 to $25,000 depending on household income

and total number of family members.

Applicants in Columbia, Suwannee and Madison

County must attend a home ownership class.

The next classes are scheduled for October 19th and

20th for Columbia County and December 5th and 6th for

Suwannee County.

Each county has its own lending criteria. For more

information contact Matt Pearson.

mattpearson@suwanneeec.net

SHIP applicants in Columbia, Lafayette, Madison,

Suwannee, and Union County can qualify for down

SHIP payment assistance for amounts between

$12,000 to $25,000 depending on household income

and total number of family members.

Applicants in Columbia, Suwannee and Madison

County must attend a home ownership class.

The next classes are scheduled for October 19th and

20th for Columbia County and December 5th and 6th for

Suwannee County.

Each county has its own lending criteria. For more

information contact Matt Pearson.

mattpearson@suwanneeec.net

Monday, August 22, 2011

Res.net Foreclosure & Short Sale Managment Real Estate

For Immediate Release:

For Immediate Release:Chad Stewart, Broker Associate with Burbach Realty has just completed training & is now a RES.net REO certified Agent. The AMP certification course give agents the opportunity to advance their REO real estate business skils.

Res.net AMP puts the agent at the center of the RES.NET community, ultimately empowering their position in the real estate transaction. From start to finish, the Accelerated Management Platform (AMP) connects agents to a community of real estate professionals, buyers, and sellers and provides them with tools to accomplish work in the most efficient manner possible

Wednesday, July 27, 2011

July 27, 2011

Attention: Selling Agents

Freddie Mac First Look Initiative Extended to Second Home Purchasers

Effective August 1, 2011, Freddie Mac will offer second home purchasers the opportunity to purchase HomeSteps homes through the Freddie Mac First Look Initiative. The First Look Initiative supports Freddie Mac's mission to stabilize communities and support housing recovery through the creation of affordable home ownership opportunities.

This on-going initiative offers owner occupant homebuyers, second home purchasers, Neighborhood Stabilization Program (NSP) grantees and non-profits engaged in community stabilization efforts the ability to purchase HomeSteps homes during their initial 15 days of listing without competition from investors.

Please Note:

Attention: Selling Agents

Freddie Mac First Look Initiative Extended to Second Home Purchasers

Effective August 1, 2011, Freddie Mac will offer second home purchasers the opportunity to purchase HomeSteps homes through the Freddie Mac First Look Initiative. The First Look Initiative supports Freddie Mac's mission to stabilize communities and support housing recovery through the creation of affordable home ownership opportunities.

This on-going initiative offers owner occupant homebuyers, second home purchasers, Neighborhood Stabilization Program (NSP) grantees and non-profits engaged in community stabilization efforts the ability to purchase HomeSteps homes during their initial 15 days of listing without competition from investors.

Please Note:

- The purchaser does not need to be a first time homebuyer to be eligible; however, they must be buying the home as their residence.

- The Affidavit of Owner Occupancy has been updated and should be used on all new sales.

- The 15 day Initiative time period is based on MLS days, not the date of the listing broker listing.

- In Nevada, Freddie Mac's First Look Initiative window is 30 days.

Tuesday, June 14, 2011

Lake City Florida - Columbia County Real Estate Market update

|

| Lake City FL Homes Info |

Greetings! Chad Stewart here with Burbach Realty Services, I just wanted to give you a quick update about our real estate market. Right now in Lake City - Columbia County, we have over 375 homes on the market. With about 75 real estate single family homes sales over the past 3 months, we have around 15 months of supply. While this is still alot, this is down from 17-22 months in previous quarters showing a slight improvement in the market.

Of those 375 homes in the county listed for sale, just over 74 of them (19%) are Foreclosures or Short Sales. Only 18 Foreclosures on the market, but 56 short sales for sale or 14% of the listings.

Of all 2011 YTD single family residential home sales here in Lake City, FL, Columbia County, Florida, and Fort White area, there is a total of 119 sales year to date, 51 of those are Foreclosures & short Sales.

Detailed Look

Detailed Look19% of the Listings are Foreclosures & Short sales, but

43% of the Sales are Foreclosures & Short sales.

31% of the sales are Foreclosures.

10% of the sales are Short Sales.

Average Home Sale: $117,000 & Median is $101,000

Average Foreclosure-Short Sale: $95,900 & Median is $79,000

Pending Sales follows along with sales as well although more weighted to pending short sales because they can take much longer & more difficult to actually close. Currently there are 42 pending home sales, 23 of those pending sales or approx 54% are foreclosures & short sales. 11 of those 23 are foreclosures and 12 are short sales.

Given these stats, you can see why hiring a quality Real Estate Pro that is knowledgeable in the area sales, especially short sales negotiations, and has a state of the art marketing plan can be important.

Thanks again. Please comment below if you find these stats interesting. - Chad

Tuesday, May 10, 2011

Lake City FL Real Estate Newsletter

|

| Lake City FL Real Estate |

Housing Trends Real Estate eNewsletter is just posted.

Check it out here

http://chadstewart.housingtrendsenewsletter.com/?Newsletter_ID=271

Monday, May 02, 2011

How to Sell your Home - Realtor in Lake City FL Real Estate

Great Video about how to sell your home.

For a Lake City FL Home or to sell any real estate in Lake City, FL Contact a Real Estate Pro - Chad Stewart - Burbach Realty Services

For a Lake City FL Home or to sell any real estate in Lake City, FL Contact a Real Estate Pro - Chad Stewart - Burbach Realty Services

Monday, February 28, 2011

Why Use a Professional Realtor

Buying house can be an exciting time for a Buyer, and selling a house can be an exciting time for a seller, but its important to make sure you use a Professional Realtor who is experienced & knowledgeable to help both the buyer & the seller thru the transaction..

This graph help explains some fo the work involved, AFTER the sales contract is signed. Not to metion the details & work needed to get the buyer & seller together in the market in the first place.

This graph help explains some fo the work involved, AFTER the sales contract is signed. Not to metion the details & work needed to get the buyer & seller together in the market in the first place.

Monday, February 14, 2011

Home & Real Estate Listed in Lake City, FL - Video Tour of Home

Beautiful Home in Lake City FL Listed for Sale. Check out this Video Tour. Listing agent in Chad Stewart with Burbach Realty Services. Home listed for $227,900. Upscale home in Callway subdivision of Lake City. This is well worth seeing & a great value for what is included in this top quality built home.

Monday, January 31, 2011

Foundation Announces Columbia County - Lake City FL as the First Six Pillars Community in the State of Florida

FOR IMMEDIATE RELEASE Contact: Juli Puckett, jpuckett@FLFoundation.org

(850) 521-1217

Foundation Announces Columbia County as the First

Six Pillars Community in the State of Florida

Tallahassee, Florida (January 28, 2011) – The Florida Chamber Foundation announced that Columbia County has completed the steps to becoming the first Six Pillars Community in the State of Florida during a press conference today. The event took place at Columbia County High School’s Career Center with local leaders who spearheaded this effort for the County’s economic future.

In August of 2009, Columbia County IDA started out on a mission to develop a strategic plan for their community. After a presentation by the Florida Chamber Foundation on the 2030 Project to community leaders, the Columbia County IDA recognized the importance of aligning their efforts with what was being done on a state level by the Foundation.

“Florida is embarking on a new economy and communities across the state must take an active role in designing the future of their regions,” said Dr. Dale Brill, president of the Florida Chamber Foundation. “Columbia County sets the example of how to effectively plan for a new economy that they will be a part of.”

In order to become a Six Pillars Community, a municipality in Florida must complete a 10-step process focused around the Six Pillars for Florida’s Future framework. This framework serves as an organizing force for strategic planning at local, regional and state levels. It provides a means of harnessing fragmented viewpoints into a common and consistent conversation so that thoughtful and productive planning can take place. This ensures that communities across the state of Florida will design plans unique to their area – all connected by a common language that bubbles up to inform the state plan.

“We had a dedicated team of community leaders made up primarily of private business but also included local government, who worked tirelessly to position Columbia County as a player in economic development,” said Gina Reynolds, Deputy Director, Columbia County IDA. “The Six Pillars Community designation offers us the power of collective resources and a unified vision which will bubble up to state-wide efforts.”

The Columbia County IDA identified five strategic goals that will position the county for prosperity, high-wage jobs, and the ability to compete in a global market:

1. The Right Portfolio of Sites

2. High Performing RACEC Catalyst Site

3. Unprecedented Customer Service

4. Outstanding Market Communications

5. Engaged and Informed Partners

Implementation of the strategic goals has been a team effort of community leaders. A trained and equipped workforce is important to the future of the community’s prosperity. Community educators took the lead and developed a Career Academy for Global Logistics at Columbia High School and a Bachelors Degree in Global Logistics at Florida Gateway College. Coupled with the Employ Florida Banner Center for Global Logistics at Florida Gateway College, Columbia County is preparing their workforce in one of their target industries.

Preparations are already underway by working groups focusing on specific areas of development. The working groups will have input into the overall direction and marketing efforts of economic development

(850) 521-1217

Foundation Announces Columbia County as the First

Six Pillars Community in the State of Florida

Tallahassee, Florida (January 28, 2011) – The Florida Chamber Foundation announced that Columbia County has completed the steps to becoming the first Six Pillars Community in the State of Florida during a press conference today. The event took place at Columbia County High School’s Career Center with local leaders who spearheaded this effort for the County’s economic future.

In August of 2009, Columbia County IDA started out on a mission to develop a strategic plan for their community. After a presentation by the Florida Chamber Foundation on the 2030 Project to community leaders, the Columbia County IDA recognized the importance of aligning their efforts with what was being done on a state level by the Foundation.

“Florida is embarking on a new economy and communities across the state must take an active role in designing the future of their regions,” said Dr. Dale Brill, president of the Florida Chamber Foundation. “Columbia County sets the example of how to effectively plan for a new economy that they will be a part of.”

In order to become a Six Pillars Community, a municipality in Florida must complete a 10-step process focused around the Six Pillars for Florida’s Future framework. This framework serves as an organizing force for strategic planning at local, regional and state levels. It provides a means of harnessing fragmented viewpoints into a common and consistent conversation so that thoughtful and productive planning can take place. This ensures that communities across the state of Florida will design plans unique to their area – all connected by a common language that bubbles up to inform the state plan.

“We had a dedicated team of community leaders made up primarily of private business but also included local government, who worked tirelessly to position Columbia County as a player in economic development,” said Gina Reynolds, Deputy Director, Columbia County IDA. “The Six Pillars Community designation offers us the power of collective resources and a unified vision which will bubble up to state-wide efforts.”

The Columbia County IDA identified five strategic goals that will position the county for prosperity, high-wage jobs, and the ability to compete in a global market:

1. The Right Portfolio of Sites

2. High Performing RACEC Catalyst Site

3. Unprecedented Customer Service

4. Outstanding Market Communications

5. Engaged and Informed Partners

Implementation of the strategic goals has been a team effort of community leaders. A trained and equipped workforce is important to the future of the community’s prosperity. Community educators took the lead and developed a Career Academy for Global Logistics at Columbia High School and a Bachelors Degree in Global Logistics at Florida Gateway College. Coupled with the Employ Florida Banner Center for Global Logistics at Florida Gateway College, Columbia County is preparing their workforce in one of their target industries.

Preparations are already underway by working groups focusing on specific areas of development. The working groups will have input into the overall direction and marketing efforts of economic development

Monday, January 10, 2011

SugarSync for 2011 vs Dropbox vs LiveMesh - Great Service for Real Estate Agents

I have been using SugarSync for a month or so now & just upgraded to the paid version. You can get 30 GB of storage, sync, and back for $4.99 a month. If you work with folders in Windows XP or Windows 7 alot, this is a great service & a excellent value.

Example: I am a real estate agent & each of my customers whether they are my sellers (listings) or my buyers, each one of them has a folder. Now that I am nearly 100% all digital in my personal real estate files, I have Mozy to do a once a day backup of my files, but now I also use SugarSync as a 2nd backup. However, the primary purpose of my SugarSync is not the backup its the Sync!

When I go to a closing, I only need to bring my iPad, quicky sync that customers folder to the iPad for offline use, and off I go. Every single file is quickly & easily uploaded for backup & sync as I use my computer.

Also the service allows incredible ease of access & sync with about any device including PC, Mac, iPhone, iPad, Android, Blackberry.

I use a Blackberry Bold as well & there is a great app for viewing & sharing files. Another example is I was recently driving thru a bank teller drive thru when I got a call from another real estate agent. He wanted copies of deed restrictions of one of my listings. I simply grabbed my Blackberry Bold, selected the customers file I needed, clicked the deed restrictions, clicked email, put agent email, & within seconds, the other agent had a email link to download the deed restrictions quickly & easily.

Just another way a real estate agent can keep very up todate, very efficient, & very organized with technology, and all for very reasonable.

Hope you like my real estate tech tip. If you are interested in signing up for a FREE SugarSync 5GB account, click here and you will get 500mb bonus storage. Again its FREE, No credit card required. Its well worth trying out. - Thanks & take care. - Chad

Example: I am a real estate agent & each of my customers whether they are my sellers (listings) or my buyers, each one of them has a folder. Now that I am nearly 100% all digital in my personal real estate files, I have Mozy to do a once a day backup of my files, but now I also use SugarSync as a 2nd backup. However, the primary purpose of my SugarSync is not the backup its the Sync!

When I go to a closing, I only need to bring my iPad, quicky sync that customers folder to the iPad for offline use, and off I go. Every single file is quickly & easily uploaded for backup & sync as I use my computer.

Also the service allows incredible ease of access & sync with about any device including PC, Mac, iPhone, iPad, Android, Blackberry.

I use a Blackberry Bold as well & there is a great app for viewing & sharing files. Another example is I was recently driving thru a bank teller drive thru when I got a call from another real estate agent. He wanted copies of deed restrictions of one of my listings. I simply grabbed my Blackberry Bold, selected the customers file I needed, clicked the deed restrictions, clicked email, put agent email, & within seconds, the other agent had a email link to download the deed restrictions quickly & easily.

Just another way a real estate agent can keep very up todate, very efficient, & very organized with technology, and all for very reasonable.

Hope you like my real estate tech tip. If you are interested in signing up for a FREE SugarSync 5GB account, click here and you will get 500mb bonus storage. Again its FREE, No credit card required. Its well worth trying out. - Thanks & take care. - Chad

Monday, December 20, 2010

Here is a site that Scott Britt from Britt Surveying showed me that is very helpful with property elevations ect….. http://www.labins.org/

This is a topo site that is run by FSU with input from surveyers around the state.

From Burbach Realty Services, Real Estate Agents in the Lake City, FL area.

This is a topo site that is run by FSU with input from surveyers around the state.

From Burbach Realty Services, Real Estate Agents in the Lake City, FL area.

Monday, December 13, 2010

Columbia County - Lake City FL Houses for Sale - Market Data - Real Estate

Interesting Columbia County, Lake City FL Housing market stats to ponder:

• Current residential home total listing inventory in Columbia County is 396.

• Closed sales since Jan 1 total 296 and annualized this will be around 322 closed sales which shows a current inventory supply of 14+ months. (A normal functioning real estate market will have a 6-8 month inventory supply)

Sold stats by price/current active listings in this price range: (closed sales only through Dec 8 not to Dec 31)

100k or less: 111 sales/106 active listings

100-150k: 92 sales/95 active listings

150-200k: 51 sales/75 active listings

200-300k: 36 sales/80 active listings

300-400k: 4 sales/21 active listings

400k +: 2 sales/19 active listings

• YOU CAN DEFINITELY SEE WHERE THE ACTION HAS BEEN! 150k OR LESS THERE HAS BEEN OVER 200 SALES IN 11 MONTHS CUTTING THE INVENTORY IN THAT PRICE RANGE TO AROUND 10 MONTHS

• THE MID RANGE OF 150-200k HAS BEEN SOFT AND SHOWS 16 MONTHS OF INVENTORY. (A HEALTHY MARKET IS 6-8 MOS. INVENTORY)

• THE UGLY PART IS 200k AND UP WITH THE DEAD ZONE ABOVE 300k WHERE ONLY 6 SALES HAVE OCCURRED. WITH ONLY 42 SALES IN THIS PRICE RANGE, AND 120 CURRENT LISTINGS, WE SHOW A 30 MONTH SUPPLY IN THIS PRICE RANGE!

Information Gathered from Lake City, FL MLS From Charlie Sparks, My former Broker With Westfield Realty Group

• Current residential home total listing inventory in Columbia County is 396.

• Closed sales since Jan 1 total 296 and annualized this will be around 322 closed sales which shows a current inventory supply of 14+ months. (A normal functioning real estate market will have a 6-8 month inventory supply)

Sold stats by price/current active listings in this price range: (closed sales only through Dec 8 not to Dec 31)

100k or less: 111 sales/106 active listings

100-150k: 92 sales/95 active listings

150-200k: 51 sales/75 active listings

200-300k: 36 sales/80 active listings

300-400k: 4 sales/21 active listings

400k +: 2 sales/19 active listings

• YOU CAN DEFINITELY SEE WHERE THE ACTION HAS BEEN! 150k OR LESS THERE HAS BEEN OVER 200 SALES IN 11 MONTHS CUTTING THE INVENTORY IN THAT PRICE RANGE TO AROUND 10 MONTHS

• THE MID RANGE OF 150-200k HAS BEEN SOFT AND SHOWS 16 MONTHS OF INVENTORY. (A HEALTHY MARKET IS 6-8 MOS. INVENTORY)

• THE UGLY PART IS 200k AND UP WITH THE DEAD ZONE ABOVE 300k WHERE ONLY 6 SALES HAVE OCCURRED. WITH ONLY 42 SALES IN THIS PRICE RANGE, AND 120 CURRENT LISTINGS, WE SHOW A 30 MONTH SUPPLY IN THIS PRICE RANGE!

Information Gathered from Lake City, FL MLS From Charlie Sparks, My former Broker With Westfield Realty Group

Tuesday, November 02, 2010

Lake City FL Commercial Office & Retail Space for Lease

We have several excellent centers in Lake City, FL with commercial office or retails space available for lease. These are top quality centers are a variety of locations & prices.

These are location owned by Westfield Realty Group's sister company, Westfield Investment Group.

See the flyers here. PDF file.

These are location owned by Westfield Realty Group's sister company, Westfield Investment Group.

See the flyers here. PDF file.

Saturday, October 16, 2010

J.P. Morgan - 4th Qtr 2010 - Guide to the Markets

Here is tons of data regarding the markets, real estate, economy, business & more. Lots of charts, graphs & statistics.

Here is the report. Opens PDF.

Here is the report. Opens PDF.

Columbia County General Flood Zone Info

Here is some general information from Columbia County about Flood Zone information for the area. Helpful info to have when buying land & real estate in the Lake City, FL area

Click here for the info

Click here for the info

Tuesday, October 12, 2010

10 Things You Can Do Today To Improve Your Credit

10 things you can do to improve your credit.. There are some incredible deasl when buying a house right now, but if your credit is less than 620 range, you may miss out on the great prices & interest rates.

Now is the time to take a closer look at your credit & do all you can to get it as best you can.

http://credit.about.com/od/creditrepair/tp/improvecredit.htm

Lake City FL has great houses for sale right now in many price ranges, contact a quality lender today to get started on your loan application & find out your score.

For all your real estate, housing, MLS search, foreclosure needs for the Lake City, FL area. Come back to http://www.chadstewart.com/ & start searching.

Now is the time to take a closer look at your credit & do all you can to get it as best you can.

http://credit.about.com/od/creditrepair/tp/improvecredit.htm

Lake City FL has great houses for sale right now in many price ranges, contact a quality lender today to get started on your loan application & find out your score.

For all your real estate, housing, MLS search, foreclosure needs for the Lake City, FL area. Come back to http://www.chadstewart.com/ & start searching.

Wednesday, September 29, 2010

Lake City - Columbia County FL - Inland Port

This is from Florida Trend - & Cynthia Barnett - all credit goes to them.

Off U.S. Highway 90 outside Columbia County's Lake City, a big white sign stands incongruously in front of a forest of young pine trees: "Future Site of Inland Port." After years of work, the state and 14 counties launched the 2,500-acre industrial-development project this fall to create a catalyst for business investment in a region that suffered low wages and high unemployment rates well before the economic downturn.

http://www.floridatrend.com/article.asp?aID=53684

This is great news for the Lake City - Columbia County Florida area. This brings not only long term recognition to the area, but along with it brings new higher wage jobs, more regional county industry & business growth, and positive planned growth.

Just up the road on Hwy 90 from this site is a great multi use industrial facility for sale. Check it out here. http://www.industrialpropertyfl.com/

Also in Live Oak, FL is a prime retail & commercial development tract. See link http://commercialpropertyfla.com/

- Chad Stewart - Pro Realtor - Westfield Realty Group.

Off U.S. Highway 90 outside Columbia County's Lake City, a big white sign stands incongruously in front of a forest of young pine trees: "Future Site of Inland Port." After years of work, the state and 14 counties launched the 2,500-acre industrial-development project this fall to create a catalyst for business investment in a region that suffered low wages and high unemployment rates well before the economic downturn.

http://www.floridatrend.com/article.asp?aID=53684

This is great news for the Lake City - Columbia County Florida area. This brings not only long term recognition to the area, but along with it brings new higher wage jobs, more regional county industry & business growth, and positive planned growth.

Just up the road on Hwy 90 from this site is a great multi use industrial facility for sale. Check it out here. http://www.industrialpropertyfl.com/

Also in Live Oak, FL is a prime retail & commercial development tract. See link http://commercialpropertyfla.com/

- Chad Stewart - Pro Realtor - Westfield Realty Group.

New Real Estate Home Listing in Lake City FL by Chad Stewart - Westfield Realty

Cute & Affordable Home listed in Lake City, FL. This home is in a great location close to town , schools, & shopping. In good condition & great price for this house at $89,900. The house is a 3 bedroom, 2 bath, and is on a 1/2 acre lot.

Furniture & all Appliances included, Fridge, Stove, Dishwasher, Washer & Dryer, 2 sheds.

First get pre-qualified by a local Lake City, FL lender, then contact me or your Realtor for a showing. If you need a local lender recommendation. Click here. http://www.chadstewart.com/Featured_Lenders.html

Here is a map link to the property.

Furniture & all Appliances included, Fridge, Stove, Dishwasher, Washer & Dryer, 2 sheds.

First get pre-qualified by a local Lake City, FL lender, then contact me or your Realtor for a showing. If you need a local lender recommendation. Click here. http://www.chadstewart.com/Featured_Lenders.html

Here is a map link to the property.

Wednesday, September 22, 2010

Updated Video Tour - Lake City FL Real Estate

Lake City, FL Real Estate - Home for Sale in Callawy Subdivision. Very Nice. 3 bedroom, 2.5 bath. Upscale Interior, Quality Built, Huge Back Porch, large kitchen, 2,293 sq ft heated. 3698 sq ft under roof, plus workshop.

Tuesday, September 21, 2010

Upscale House & Real Estate for Sale in Lake City FL

Very nice house for sale in Callaway here in Lake City, FL. Well built with lots of features. 3 bedroom, 2.5 bath, about 2,293 sq ft. Large enclosed back porch with disappearing sliding doors! Wow, Check this out today. Link to youtube here. Call to schedule your tour today.

Create your own video slideshow at animoto.com.

Create your own video slideshow at animoto.com.

Saturday, August 21, 2010

Commercial Real Estate in Live Oak, FL - Suwannee County

55 +/- acre prime development tract located across the street from Wal-Mart on Hwy 129 in Live Oak, FL. This is in high commercial activity growth corridor ½ mile south of Interstate 10, in Suwannee County, FL.

http://www.commercialpropertyfla.com/

http://www.commercialpropertyfla.com/

Saturday, August 07, 2010

The Inland Port project in Lake City got good press in the Gainesville Sun today.

http://www.gainesville.com/article/20100807/ARTICLES/8071009&tc=email_newsletter

http://www.gainesville.com/article/20100807/ARTICLES/8071009&tc=email_newsletter

Thursday, July 29, 2010

The Psychology of Real Esate - Interesting

Here is an interesting article about how people think & see real estate choices & options.

http://realestate.yahoo.com/promo/the-psychology-of-real-estate.html

I definetly would reccomend painting and recarpeting if your home is showing too many signs of aging or wear an tear. This will help the buyers get past the cost & hassle of having to redo it themselves after they purchase. Most buyers will over compensate about 2-3 times for these type of items.

Example: If a buyer walks into a moderate home that needs new paint & flooring, rather than see or estimate it till take $2,500 for paint & carpet, they will estimate $5,000 to $7,500 just to be safe & offer that much less. Its good for both buyers & sellers to understand this & think logically about it to make the best decisions.

Thanks. Check back again - Chad Stewart - Westfield Realty Group - Lake City FL Real Estate Broker Associate.

http://realestate.yahoo.com/promo/the-psychology-of-real-estate.html

I definetly would reccomend painting and recarpeting if your home is showing too many signs of aging or wear an tear. This will help the buyers get past the cost & hassle of having to redo it themselves after they purchase. Most buyers will over compensate about 2-3 times for these type of items.

Example: If a buyer walks into a moderate home that needs new paint & flooring, rather than see or estimate it till take $2,500 for paint & carpet, they will estimate $5,000 to $7,500 just to be safe & offer that much less. Its good for both buyers & sellers to understand this & think logically about it to make the best decisions.

Thanks. Check back again - Chad Stewart - Westfield Realty Group - Lake City FL Real Estate Broker Associate.

Friday, July 16, 2010

Homes are extremely affordable, Especially Lake City FL Homes & Real Estate

FAR affordability index. Still running at historic highs. The average buyer has nearly twice the income necessary to buy the median priced home financed with the average fixed rate mortgage loan.

Click Here

Click Here

Tuesday, July 13, 2010

Columbia County - Lake City FL Regional Inustrial Development News

RePost from Columbia County FL Industrial Development Authority newsletter. Lake City, FL is definetly a up & coming place for regional development, and long term growth & stability for Florida.

The Columbia County Industrial Development Authority is busy working on several projects for the betterment of Columbia County, the region and the state. To keep you up to date with activities involving economic development in Columbia County, we have attached several articles for your perusal. If you missed previously released articles and columns, they can be viewed by visiting our link on the County’s website, http://www.columbiacountyfla.com/IDA.asp or you may click on one of the links to previous articles provided below. We are working diligently to develop our own website and will notify you upon completion.

Recent links relevant to economic development in Columbia County:

IDA Column: Historic meeting marks unified effort to transforms area’s economy : http://www.lakecityjournal.com/main.asp?SectionID=15&SubSectionID=75&ArticleID=6172

Jacksonville Business Journal: http://www.bizjournals.com/jacksonville/stories/2010/06/28/daily4.html?ana=e_du_pap

St. Leo University preparing students for International Trade: Here

Officials discuss major projects to prepare Columbia County as Inland Port: Article Here

Poole, Huddleston and Reynolds selected for Florida Chamber Foundation’s Caucus System: Link Here

Plum Creek and Columbia County Team Up for Job Creation: http://www.plumcreek.com/tabid/73/itemid/981/Plum-Creek-and-Columbia-County-Team-Up-for-Job-Cre.aspx

Foundation Grants Making Impact on Education: Read here

The Columbia County Industrial Development Authority Board meets the first Wednesday of every month at 8:30 a.m. at the Lake Shore Hospital Authority. The meetings are open to the public and we welcome your attendance.

Posted by Chad Stewart, Westfield Realty Group, Credit goes to article writers, and CCFLIda

The Columbia County Industrial Development Authority is busy working on several projects for the betterment of Columbia County, the region and the state. To keep you up to date with activities involving economic development in Columbia County, we have attached several articles for your perusal. If you missed previously released articles and columns, they can be viewed by visiting our link on the County’s website, http://www.columbiacountyfla.com/IDA.asp or you may click on one of the links to previous articles provided below. We are working diligently to develop our own website and will notify you upon completion.

Recent links relevant to economic development in Columbia County:

IDA Column: Historic meeting marks unified effort to transforms area’s economy : http://www.lakecityjournal.com/main.asp?SectionID=15&SubSectionID=75&ArticleID=6172

Jacksonville Business Journal: http://www.bizjournals.com/jacksonville/stories/2010/06/28/daily4.html?ana=e_du_pap

St. Leo University preparing students for International Trade: Here

Officials discuss major projects to prepare Columbia County as Inland Port: Article Here

Poole, Huddleston and Reynolds selected for Florida Chamber Foundation’s Caucus System: Link Here

Plum Creek and Columbia County Team Up for Job Creation: http://www.plumcreek.com/tabid/73/itemid/981/Plum-Creek-and-Columbia-County-Team-Up-for-Job-Cre.aspx

Foundation Grants Making Impact on Education: Read here

The Columbia County Industrial Development Authority Board meets the first Wednesday of every month at 8:30 a.m. at the Lake Shore Hospital Authority. The meetings are open to the public and we welcome your attendance.

Posted by Chad Stewart, Westfield Realty Group, Credit goes to article writers, and CCFLIda

Thursday, July 01, 2010

Homebuyer Tax credit extension.

Repost of FL Realtors Information:

Congress extends homebuyer tax credit and flood insurance

The U.S. Senate passed two bills last evening previously passed by the House. Both bills still need President Obama's signature to become law, but that's expected to happen quickly.

Homebuyer tax credit:

The Senate passed HR 5623, which extends the mandatory closing date to qualify for the homebuyer tax credit. The contract deadline does not change - homebuyers must have a contract signed by April 30, 2010 (an exception for active duty military) - but the previous closing deadline of June 30, 2010, has been extended to Sept. 30, 2010. The National Association of Realtors estimates that the approved bill will benefit more than 14,000 deals in Florida.

Congress extends homebuyer tax credit and flood insurance

The U.S. Senate passed two bills last evening previously passed by the House. Both bills still need President Obama's signature to become law, but that's expected to happen quickly.

Homebuyer tax credit:

The Senate passed HR 5623, which extends the mandatory closing date to qualify for the homebuyer tax credit. The contract deadline does not change - homebuyers must have a contract signed by April 30, 2010 (an exception for active duty military) - but the previous closing deadline of June 30, 2010, has been extended to Sept. 30, 2010. The National Association of Realtors estimates that the approved bill will benefit more than 14,000 deals in Florida.

Friday, June 18, 2010

Lake City FL Phone Book & Directories

If you are looking for a Phone Book for the Lake City, FL area. Here are a couple resources for you. Of course Google is what I use for searching for real estate or anything about a city like Lake City, FL, but sometimes it might be nice to just browse the phone book.

Local Edge - the Talking Phone Book - Lake City - Live Oak

http://www.localedge.com/laci

At&t - Bellsouth - Real Yellow Pages for Lake City

http://www.realpageslive.com/WebProject.asp?BookCode=lkf09htm&from=2

Google Local

Local Edge - the Talking Phone Book - Lake City - Live Oak

http://www.localedge.com/laci

At&t - Bellsouth - Real Yellow Pages for Lake City

http://www.realpageslive.com/WebProject.asp?BookCode=lkf09htm&from=2

Google Local

Friday, April 30, 2010

Here is an encouraging report. We continue to build on the good news momentum.

http://www.floridarealtors.org/NewsAndEvents/article.cfm?id=238713

http://www.floridarealtors.org/NewsAndEvents/article.cfm?id=238713

Thursday, April 15, 2010

More Keep up with Mortgage Payments

http://www.floridarealtors.org/NewsAndEvents/article.cfm?id=237847

This is a good sign. Note the comment about strategic foreclosures. I think you will see this problem fade as the banks toughen up and the economy strengthens. I think we will look back at 2010 as the big washout year. It will carry into future year(s) but this may be the high water mark this year. - from: Charlie Sparks. Broker at Westfield Realty Group.

This is a good sign. Note the comment about strategic foreclosures. I think you will see this problem fade as the banks toughen up and the economy strengthens. I think we will look back at 2010 as the big washout year. It will carry into future year(s) but this may be the high water mark this year. - from: Charlie Sparks. Broker at Westfield Realty Group.

Friday, March 26, 2010

Open House - Come Visit Me in Lake City, FL

Come Visit me April 10-11. We are participating in a statewide Florida Open House even, April 10-11.

I will be at a house located at 205 SW Scott Place, Lake City, FL. This is in the Russwood subdivision. A brand new top quality home. Spacious Floor Plan, has 4 bedrooms plus an office. Two living areas, two dining areass, covered porch and a triple garage. All of this priced at only $298,900! Give me a call 386-867-1782. Directions, Take Branford Hwy (SR 247) south to Troy Rd, west to Russwood subdivision, go to back of development to house. Click Here for a Map.

This blog has moved

This blog is now located at http://blog.chadstewart.com/.

You will be automatically redirected in 30 seconds, or you may click here.

For feed subscribers, please update your feed subscriptions to

http://blog.chadstewart.com/feeds/posts/default.

Saturday, February 27, 2010

Subscribe to:

Posts (Atom)